accumulated earnings tax calculation example

Calculating the Accumulated Earnings Tax. The information contained herein is of a general nature and based on authorities that are subject to change.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

The Tax Court held for the IRS on both the compensation and accumulated earnings tax issues.

. The threshold is 25000 without accumulated earning tax. Excess of long-term capital gains over long-term capital losses taxed at 34 percent. A corporation may be allowed an accumulated earnings credit in the na-ture of a deduction in computing accu-mulated taxable income to the extent it.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. It compensates for taxes which cannot be levied on dividends.

Any tax opinions memoranda or other tax analyses contained in those materials. Breaking Down Accumulated Earnings Tax. 8 rows Example.

Facts Corp had 300000 of taxable income and paid 100250 in federal income tax on that amount. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. Less than 20 percent owned dividends.

IRC Section 535c1 provides that. Other examples of negative EP adjustments include the payment of nondeductible fines and penalties 8 interest expense related to tax-exempt income 9 club dues 10 legal lobbying expenses and political contributions 11 excess charitable contributions 12 and capital loss carryforwards. Therefore the total beginning balance is 60 billion.

Accumulated Earnings Tax Portfolio 796 Part of Bloomberg Tax Subscription. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Net operating loss carryover.

Dividends received deduction of 10000 and NOL deduction of 40000. There is a certain level in which the number of earnings of C corporations can get. Accumulated Earnings Calculation Example.

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes. The dividends paid to shareholders of preferred and common stocks amount to 2725 million. Accumulated EP on January.

The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC Section 535 by 20. In this example the company ABC has a beginning balance of 33 billion and a net income of 27 million. 796 analyzes in detail the problems associated with a corporations failure to distribute its earnings and profits with the purpose of avoiding the tax on its shareholders.

Accumulated Earnings Tax can be reduced by reducing Accumulated Taxable Income. The IRS audited the 1965 and 1966 returns and assessed the accumulated earnings tax in the amount of approximately 150000. Bloomberg Tax Portfolio Accumulated Earnings Tax No.

This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid high levels of taxation. Accumulated earnings as of the end of last year. The regular corporate income tax.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Therefore once your retained earnings exceed those limits you need to be concerned about the AET and document why your corporation needs accumulated earnings exceeding that amount. Avalara provides supported pre-built integration.

It required the parties to compute the new tax liability based on the corporations holdings under the courts rule 155. TaxInterest is the standard that helps you calculate the correct amounts. 13 This is just a sampling of the types of nondeductible expenses that must be.

In 1966 the Xerox stock and debentures had a tax basis to the corporation of 130000 and a FMV of 2550000. Ad Determine Working Capital Needs with the Bardahl Formula. If the accumulated earnings tax applies interest applies to the tax from the date the corporate return was originally due without extensions.

According to the IRS anything. Keep in mind the IRS allows for an accumulated earnings credit of 250000 or 150000 if you are taxed as a Personal Service Corporation. X must reduce its EP of 1000 by its 300 tax liability at the close of 2008 despite the fact that the 300 tax liability is not deductible for.

Applicability of the information to specific situations should be determined through consultation with your tax adviser. Accumulated income credit is 50000 Calculations Taxable Income. The undistributed earnings of the corporation during this period were approximately 23 million.

The parties disagreed on the correct tax computation and instituted the current case to determine the right amount. To determine if the corporation is subject to this tax first treat an accumulation of 250000 or less generally.

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part Ii

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Determining The Taxability Of S Corporation Distributions Part I

Sale Of Stock Of A Cfc Example Of The Potential Benefit Of Code 1248 B International Tax Blog

Cost Of Retained Earnings Commercestudyguide

Earnings And Profits Computation Case Study

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Determining The Taxability Of S Corporation Distributions Part Ii

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

What Are Earnings After Tax Bdc Ca

What Are Accumulated Earnings Definition Meaning Example

Demystifying Irc Section 965 Math The Cpa Journal

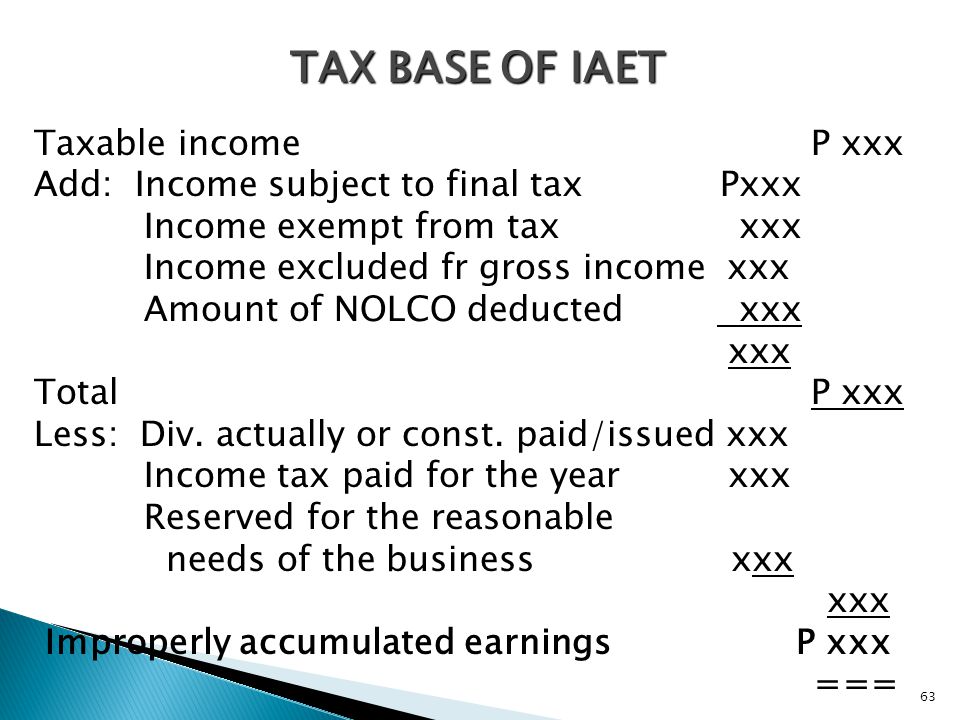

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc